Transaction fees. If you use creator platforms, tools, and software to build your online business, you've probably encountered your share of them.

Whether you sell online courses about basket weaving or offer an ebook of fancy toast recipes, creator platforms help you house your work, accept payments, and manage the backend of your business.

These platforms have to make money to keep the lights on, so they often charge users transaction fees, a flat monthly subscription, or a combination of both.

A transaction fee is a small sum the company takes when you make a sale using their platform. The amount you pay is almost always a percentage of your earnings. If you make a $100 sale using software that charges a 5% transaction fee, they keep $5, and you keep $95.

Transaction fees are separate from other platform costs, like payment processing fees, listing fees, and recurring subscription fees. Juggling all these expenses can be confusing, so here's a quick breakdown:

-

Payment processing fees: Payment processors (e.g., Stripe, PayPal) charge their own rates in addition to platform transaction fees. The amount varies based on which processor you use, your location, and your customers' location.

-

Listing fees: If you sell through an online marketplace, you may have to pay to list products. For example, Etsy charges a $0.20 listing fee for each item you add to your store, in addition to their 6.5% transaction fee and payment processing fees.

-

Monthly subscription costs: Many tools charge a set monthly rate to use the software, regardless of your sales. You can choose from multiple plans with advanced features at higher price points.

At first glance, transaction fees can feel frustrating for creators. These extra expenditures increase as your revenue grows, and they can quickly make a "free" platform very expensive. You work hard to earn your money, and you deserve to keep it.

But on the flip side, there are instances when paying transaction fees to use a tool — specifically, a free one — can work in your favor. This post will cover when transaction fees are the right move, things to watch out for, and how to calculate when it's time to leave transaction fees in the dust by upgrading or switching platforms.

Transaction fees on free plans help early-stage creators save money

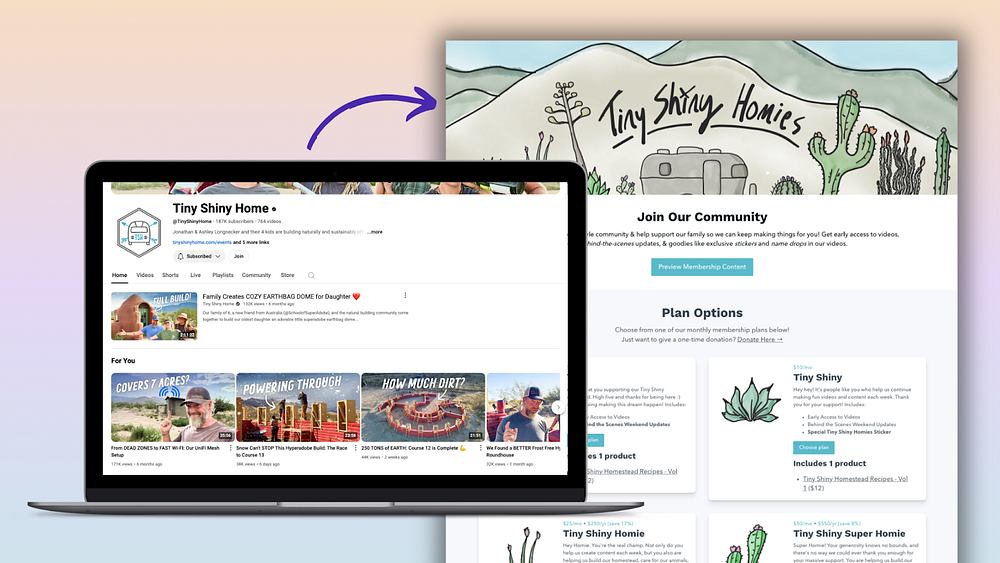

If you're building your online business on a small budget, you're not alone. Many creator platforms provide a free plan with transaction fees in addition to their standard paid plans. This is great for new creators because you’ll only pay the platform when you make a sale, meaning you can get your brand off the ground without fronting a mountain of cash.

Let's pretend you want to sell your first ebook. Platform A is a free tool that charges a 5% transaction fee per sale, and Platform B is a paid tool that costs $100 per month but doesn't charge transaction fees.

It takes a few weeks to write your ebook and iron out your marketing, so in the first month, you earn $0.

-

With Platform A, you will pay $0.

-

With Platform B, you will pay $100.

In month two, you grow your audience and earn $1000.

-

With Platform A, you will pay $50.

-

With Platform B, you will pay $100.

In month three, business slows down, and you only earn $500.

-

With Platform A, you will pay $25.

-

With Platform B, you will still have to pay $100.

A free plan with transaction fees may be more affordable in the early stages of your business, and if you have a slow month, you won’t face a hefty bill. This is more creator-friendly for beginners than a flat monthly fee, assuming you have the option to upgrade and remove transaction fees later.

Transaction fee red flags to avoid

Unfavorable transaction fee policies can cause problems as your business grows. Here are some things to watch out for:

#1 Transaction fees that can't be removed by upgrading plans

With transaction fees, the more you earn, the more you'll pay.

When a platform only has transaction fees on its free plan, switching to a flat rate plan once your sales hit a certain level can save you hundreds per month. But some platforms have transaction fees on all of their plans, leaving you trapped.

If you earn $100 per month using a platform that universally charges 5%, you will pay $5 in transaction fees. If you earn $10,000 per month, you will pay $500. That's a big difference.

Simply put, transaction fees are fine when your earnings are small, but they penalize higher earners. To get around this, pick a platform where you can upgrade away from transaction fees and grow without limits.

(You can remove all transaction fees with Podia's Shaker plan!)

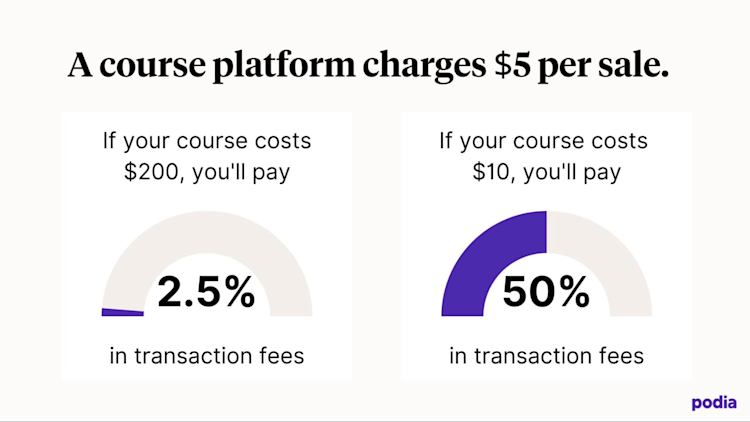

#2 Specific dollar amount transaction fees

Some platforms charge a set dollar amount instead of a percentage-based transaction fee, posing a problem for creators with lower-ticket offers.

Suppose your software charges a flat rate of $5 per sale. This is fine if your courses are $200 a pop, but if you want to sell a $10 workshop, you're handing over 50% of your revenue. Instead, stick with percentage-based fee structures more reflective of your earnings.

#3 Unusually high transaction fees

Standard transaction fees are small percentages, but some companies take a substantially higher cut in exchange for access to their marketplace and existing audience.

Under Udemy's revenue share model, for example, instructors keep only 37% of their earnings unless students use the teacher's referral code. Podia course creator John D. Saunders went from pocketing $1,100 on Udemy with 1,900 students to earning $10,000 in a single day when he switched to a transaction-fee-free Podia plan.

Forfeiting this much of your income, even in exchange for greater visibility, won't be the best fit for many creators.

Here's how to calculate if it's time to wave transaction fees goodbye once and for all.

Calculating the right time to upgrade and banish transaction fees

There's a turning point where you'll spend more using a free plan with transaction fees than you would with a set monthly payment.

Imagine you use a platform with a free plan (8% transaction fee) and a $30 per month premium plan (0% transaction fee). If you earn $50 a month, you'll pay $4 on the free plan and $30 on the premium plan.

But if you earn $500 a month, you'll pay $40 in transaction fees on the free plan, which is more than you would pay for the premium option. It's more affordable to switch, and you’ll likely unlock additional features.

If you earn $5000 a month, you'll pay a whopping $400 in transaction fees on the free plan. Had you upgraded to the premium plan, you'd still only pay $30 a month, saving you $370.

Bottom line: A free or low-cost plan with transaction fees is suitable for beginners, but a flat rate plan is better as your business grows.

Here at Podia, we intentionally designed our plans to remove barriers to entry when you're new but not penalize you as you grow. We've got your back at every stage of the creator journey, so grab your free 30-day trial today to start building an online business you love.